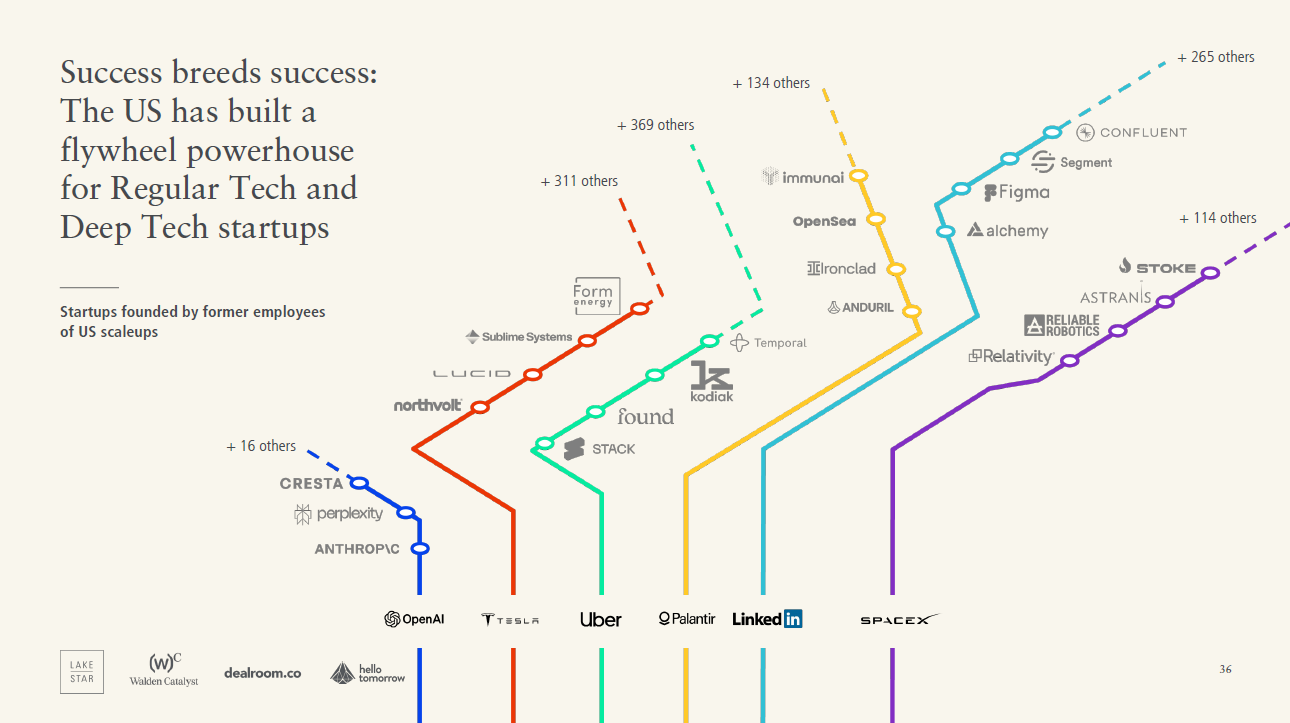

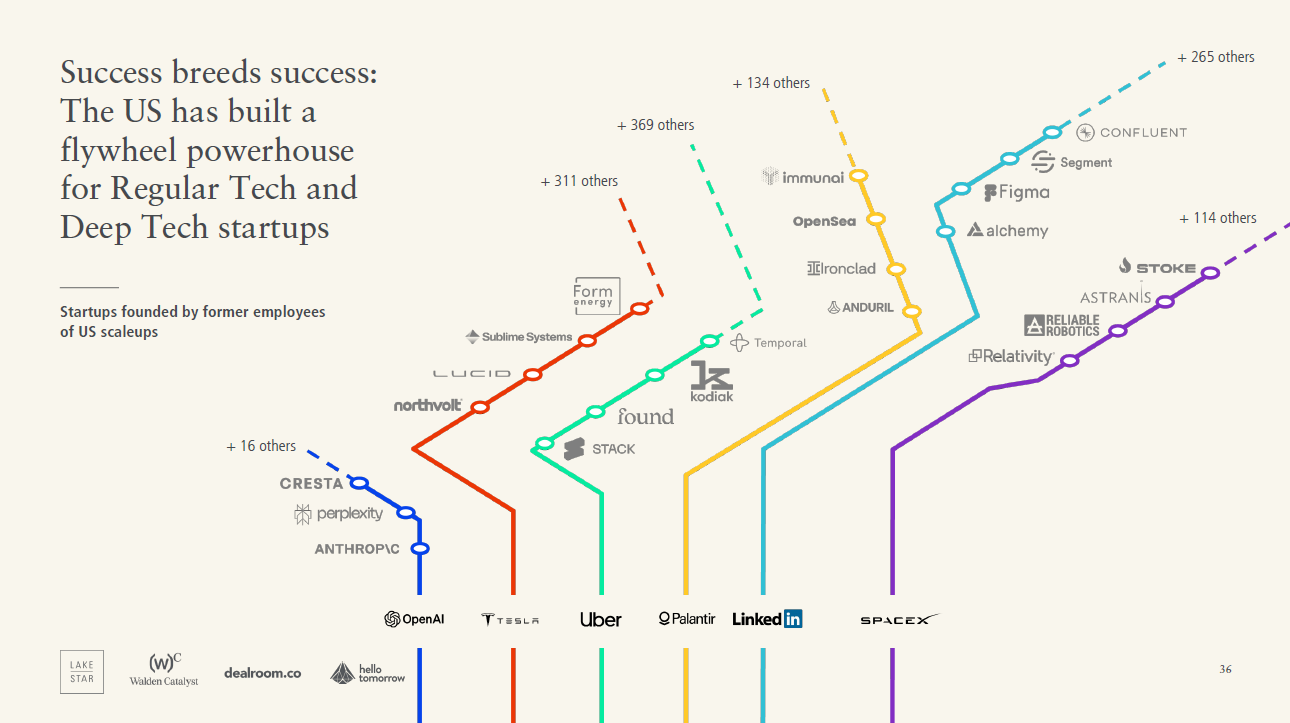

Every great tech ecosystem has a flywheel. Founders exit, reinvest, and launch again. VCs recycle capital into new funds. Angels step in. Talent flows from unicorn to unicorn, compounding knowledge and confidence.

Silicon Valley's flywheel is legendary the PayPal Mafia spun into Tesla, SpaceX, and Palantir. China's BAT (Baidu, Alibaba, Tencent) generation seeded hundreds of new ventures.

But in European deep tech? The flywheel still stutters. The 2025 European Deep Tech Report makes this clear: Europe produces groundbreaking innovation, but the value capture, exits, and reinvestment loops are still weak.

🔄 What a Healthy Flywheel Looks Like

The formula isn't complicated:

A startup scales and exits via IPO or acquisition.

Founders, employees, and investors cash out.

That capital, experience, and confidence get recycled into new ventures.

The cycle compounds over time.

Without this, ecosystems remain stuck in "R&D labs" rather than becoming global tech powerhouses.

📊 The State of Play: Exits Aren't Spinning the Wheel

In 2024, European deep tech generated $12.2 billion in M&A exits, but most buyers were non-European corporates (largely US).

IPOs remain rare. LightOn (France) listed on Euronext Growth, Ottobock (Germany) is preparing a €4B IPO but these are exceptions, not the rule.

Half of growth capital for European deep tech still comes from non-European investors.

My take: Europe is effectively exporting its wins. We create the IP, talent, and early momentum, but the real value capture happens elsewhere. That's not a flywheel it's a leakage loop.

🌍 US vs Europe: Two Different Flywheels

The US flywheel is well-oiled. Success breeds success. Employees from companies like Tesla, Palantir, LinkedIn, and SpaceX spin out new startups that raise billions. Each generation of exits fuels the next.

The US flywheel is well-oiled. Success breeds success. Employees from companies like Tesla, Palantir, LinkedIn, and SpaceX spin out new startups that raise billions. Each generation of exits fuels the next.

Europe's flywheel is catching up but it's still driven mostly by "shallow tech." Spotify, Revolut, Zalando, and Klarna have seeded plenty of new ventures, but less than 5% of those spinouts are deep tech.

The gap is clear:

The US has a decades-long culture of reinvestment, risk-taking, and patient capital.

Europe is only just building its deep tech flywheel. The ingredients are there VC allocation, high-profile startups, and sophisticated angels but momentum is still thin compared to the US.

💡 Why the Flywheel Matters

Without strong exits:

Founders reinvest abroad instead of locally.

Talent leaves when US acquirers swoop in.

Investors look at Europe as an innovation lab, not a scale-up market.

If the flywheel doesn't turn, Europe risks becoming the R&D department for the world brilliant at science, poor at scaling.

⚠️ The UK IPO Market: A Case Study in What's Broken

Nowhere is this clearer than in the UK. London should be the natural listing home for European deep tech. Instead, the IPO market has collapsed.

H1 2025: Only nine IPOs on the London Stock Exchange, raising £182.8m down 64% year-on-year. (EY, July 2025)

Q1 2025: Just five IPOs, raising £74.7m a 74% drop vs Q1 2025. (EY, April 2025)

Fundraising hit a 30-year low, with just £160m raised across all LSE IPOs in H1. (FT, July 2025)

My opinion: It's hard to overstate how bad this looks. If you're a founder weighing where to list London or Nasdaq the data makes the choice for you. The UK has all the ingredients (universities, talent, capital), but exits aren't credible. And without credible exits, the flywheel doesn't spin.

🛠️ How Do We Fix It?

Here's where I get opinionated: the UK and Europe can fix this, but it requires policy, structural, and cultural shifts.

1. Tax Incentives for IPOs

Exempt newly listed shares from the 0.5% stamp duty.

Offer favorable capital gains treatment for IPO investors. 👉 Listing in London should be cheaper than in New York, not more expensive.

2. Ease Regulatory Burdens

Streamline compliance and reduce costs for AIM and main market listings.

Make dual listings easier and cheaper. 👉 Right now, only giants can afford the friction. Deep tech startups shouldn't have to bleed out before they get public.

3. Mobilize Scale-Up Capital

Expand government grant funding by increasing GDP spend.

Push pension funds into late-stage venture and IPO participation. 👉 Europe doesn't lack capital. It lacks risk-tolerant domestic capital.

4. Support IPO Readiness

Programs to help founders with governance, reporting, underwriting, and valuation.

Governments could co-invest in IPO infrastructure (market making, liquidity support). 👉 Reduce fragility. Make IPOs something companies aim for, not fear.

5. Culture Shift

Stop stigmatizing failure. Encourage second and third-time founders. 👉 Silicon Valley works because failure isn't final. Europe still treats it like a scarlet letter.

🌍 Signs of Hope

The flywheel isn't totally broken.

Mistral AI ($6.4B valuation) and DeepL ($300M raise) are building a new wave of AI champions.

Isar Aerospace and IceEye are anchoring space tech.

Newcleo and Marvel Fusion are pulling nuclear/energy into the mainstream.

These companies could be the seeds of a European deep tech flywheel but only if they scale here, exit here, and reinvest here.

🚀 Final Thought

Europe doesn't lack talent. It doesn't lack innovation. It doesn't even lack capital. What it lacks is an engine that recycles success back into the system. Comparing the US to EU is like comparing Apples to Oranges. I'm not blind to that fact but we can be better and i believe we will be.

Until we fix exits especially IPOs we'll keep exporting the upside. The UK in particular has a choice: revive London as a credible IPO hub, or watch founders go abroad.

2025 could be remembered as the year Europe stopped asking "Can we compete?" and started asking "How do we spin the flywheel faster?"

This blog is part of my mini-series on the 2025 European Deep Tech Report. Next week: I'll dive into the companies, R&D hubs, and culture shaping Europe's deep tech ecosystem.

Europe's flywheel is catching up but it's still driven mostly by "shallow tech." Spotify, Revolut, Zalando, and Klarna have seeded plenty of new ventures, but less than 5% of those spinouts are deep tech.

The gap is clear:

The US has a decades-long culture of reinvestment, risk-taking, and patient capital.

Europe is only just building its deep tech flywheel. The ingredients are there VC allocation, high-profile startups, and sophisticated angels but momentum is still thin compared to the US.

💡 Why the Flywheel Matters

Without strong exits:

Founders reinvest abroad instead of locally.

Talent leaves when US acquirers swoop in.

Investors look at Europe as an innovation lab, not a scale-up market.

If the flywheel doesn't turn, Europe risks becoming the R&D department for the world brilliant at science, poor at scaling.

⚠️ The UK IPO Market: A Case Study in What's Broken

Nowhere is this clearer than in the UK. London should be the natural listing home for European deep tech. Instead, the IPO market has collapsed.

H1 2025: Only nine IPOs on the London Stock Exchange, raising £182.8m down 64% year-on-year. (EY, July 2025)

Q1 2025: Just five IPOs, raising £74.7m a 74% drop vs Q1 2025. (EY, April 2025)

Fundraising hit a 30-year low, with just £160m raised across all LSE IPOs in H1. (FT, July 2025)

My opinion: It's hard to overstate how bad this looks. If you're a founder weighing where to list London or Nasdaq the data makes the choice for you. The UK has all the ingredients (universities, talent, capital), but exits aren't credible. And without credible exits, the flywheel doesn't spin.

🛠️ How Do We Fix It?

Here's where I get opinionated: the UK and Europe can fix this, but it requires policy, structural, and cultural shifts.

1. Tax Incentives for IPOs

Exempt newly listed shares from the 0.5% stamp duty.

Offer favorable capital gains treatment for IPO investors. 👉 Listing in London should be cheaper than in New York, not more expensive.

2. Ease Regulatory Burdens

Streamline compliance and reduce costs for AIM and main market listings.

Make dual listings easier and cheaper. 👉 Right now, only giants can afford the friction. Deep tech startups shouldn't have to bleed out before they get public.

3. Mobilize Scale-Up Capital

Expand government grant funding by increasing GDP spend.

Push pension funds into late-stage venture and IPO participation. 👉 Europe doesn't lack capital. It lacks risk-tolerant domestic capital.

4. Support IPO Readiness

Programs to help founders with governance, reporting, underwriting, and valuation.

Governments could co-invest in IPO infrastructure (market making, liquidity support). 👉 Reduce fragility. Make IPOs something companies aim for, not fear.

5. Culture Shift

Stop stigmatizing failure. Encourage second and third-time founders. 👉 Silicon Valley works because failure isn't final. Europe still treats it like a scarlet letter.

🌍 Signs of Hope

The flywheel isn't totally broken.

Mistral AI ($6.4B valuation) and DeepL ($300M raise) are building a new wave of AI champions.

Isar Aerospace and IceEye are anchoring space tech.

Newcleo and Marvel Fusion are pulling nuclear/energy into the mainstream.

These companies could be the seeds of a European deep tech flywheel but only if they scale here, exit here, and reinvest here.

🚀 Final Thought

Europe doesn't lack talent. It doesn't lack innovation. It doesn't even lack capital. What it lacks is an engine that recycles success back into the system. Comparing the US to EU is like comparing Apples to Oranges. I'm not blind to that fact but we can be better and i believe we will be.

Until we fix exits especially IPOs we'll keep exporting the upside. The UK in particular has a choice: revive London as a credible IPO hub, or watch founders go abroad.

2025 could be remembered as the year Europe stopped asking "Can we compete?" and started asking "How do we spin the flywheel faster?"

This blog is part of my mini-series on the 2025 European Deep Tech Report. Next week: I'll dive into the companies, R&D hubs, and culture shaping Europe's deep tech ecosystem.

The US flywheel is well-oiled. Success breeds success. Employees from companies like Tesla, Palantir, LinkedIn, and SpaceX spin out new startups that raise billions. Each generation of exits fuels the next.

The US flywheel is well-oiled. Success breeds success. Employees from companies like Tesla, Palantir, LinkedIn, and SpaceX spin out new startups that raise billions. Each generation of exits fuels the next.

Europe's flywheel is catching up but it's still driven mostly by "shallow tech." Spotify, Revolut, Zalando, and Klarna have seeded plenty of new ventures, but less than 5% of those spinouts are deep tech.

The gap is clear:

The US has a decades-long culture of reinvestment, risk-taking, and patient capital.

Europe is only just building its deep tech flywheel. The ingredients are there VC allocation, high-profile startups, and sophisticated angels but momentum is still thin compared to the US.

💡 Why the Flywheel Matters

Without strong exits:

Founders reinvest abroad instead of locally.

Talent leaves when US acquirers swoop in.

Investors look at Europe as an innovation lab, not a scale-up market.

If the flywheel doesn't turn, Europe risks becoming the R&D department for the world brilliant at science, poor at scaling.

⚠️ The UK IPO Market: A Case Study in What's Broken

Nowhere is this clearer than in the UK. London should be the natural listing home for European deep tech. Instead, the IPO market has collapsed.

H1 2025: Only nine IPOs on the London Stock Exchange, raising £182.8m down 64% year-on-year. (EY, July 2025)

Q1 2025: Just five IPOs, raising £74.7m a 74% drop vs Q1 2025. (EY, April 2025)

Fundraising hit a 30-year low, with just £160m raised across all LSE IPOs in H1. (FT, July 2025)

My opinion: It's hard to overstate how bad this looks. If you're a founder weighing where to list London or Nasdaq the data makes the choice for you. The UK has all the ingredients (universities, talent, capital), but exits aren't credible. And without credible exits, the flywheel doesn't spin.

🛠️ How Do We Fix It?

Here's where I get opinionated: the UK and Europe can fix this, but it requires policy, structural, and cultural shifts.

1. Tax Incentives for IPOs

Exempt newly listed shares from the 0.5% stamp duty.

Offer favorable capital gains treatment for IPO investors. 👉 Listing in London should be cheaper than in New York, not more expensive.

2. Ease Regulatory Burdens

Streamline compliance and reduce costs for AIM and main market listings.

Make dual listings easier and cheaper. 👉 Right now, only giants can afford the friction. Deep tech startups shouldn't have to bleed out before they get public.

3. Mobilize Scale-Up Capital

Expand government grant funding by increasing GDP spend.

Push pension funds into late-stage venture and IPO participation. 👉 Europe doesn't lack capital. It lacks risk-tolerant domestic capital.

4. Support IPO Readiness

Programs to help founders with governance, reporting, underwriting, and valuation.

Governments could co-invest in IPO infrastructure (market making, liquidity support). 👉 Reduce fragility. Make IPOs something companies aim for, not fear.

5. Culture Shift

Stop stigmatizing failure. Encourage second and third-time founders. 👉 Silicon Valley works because failure isn't final. Europe still treats it like a scarlet letter.

🌍 Signs of Hope

The flywheel isn't totally broken.

Mistral AI ($6.4B valuation) and DeepL ($300M raise) are building a new wave of AI champions.

Isar Aerospace and IceEye are anchoring space tech.

Newcleo and Marvel Fusion are pulling nuclear/energy into the mainstream.

These companies could be the seeds of a European deep tech flywheel but only if they scale here, exit here, and reinvest here.

🚀 Final Thought

Europe doesn't lack talent. It doesn't lack innovation. It doesn't even lack capital. What it lacks is an engine that recycles success back into the system. Comparing the US to EU is like comparing Apples to Oranges. I'm not blind to that fact but we can be better and i believe we will be.

Until we fix exits especially IPOs we'll keep exporting the upside. The UK in particular has a choice: revive London as a credible IPO hub, or watch founders go abroad.

2025 could be remembered as the year Europe stopped asking "Can we compete?" and started asking "How do we spin the flywheel faster?"

This blog is part of my mini-series on the 2025 European Deep Tech Report. Next week: I'll dive into the companies, R&D hubs, and culture shaping Europe's deep tech ecosystem.

Europe's flywheel is catching up but it's still driven mostly by "shallow tech." Spotify, Revolut, Zalando, and Klarna have seeded plenty of new ventures, but less than 5% of those spinouts are deep tech.

The gap is clear:

The US has a decades-long culture of reinvestment, risk-taking, and patient capital.

Europe is only just building its deep tech flywheel. The ingredients are there VC allocation, high-profile startups, and sophisticated angels but momentum is still thin compared to the US.

💡 Why the Flywheel Matters

Without strong exits:

Founders reinvest abroad instead of locally.

Talent leaves when US acquirers swoop in.

Investors look at Europe as an innovation lab, not a scale-up market.

If the flywheel doesn't turn, Europe risks becoming the R&D department for the world brilliant at science, poor at scaling.

⚠️ The UK IPO Market: A Case Study in What's Broken

Nowhere is this clearer than in the UK. London should be the natural listing home for European deep tech. Instead, the IPO market has collapsed.

H1 2025: Only nine IPOs on the London Stock Exchange, raising £182.8m down 64% year-on-year. (EY, July 2025)

Q1 2025: Just five IPOs, raising £74.7m a 74% drop vs Q1 2025. (EY, April 2025)

Fundraising hit a 30-year low, with just £160m raised across all LSE IPOs in H1. (FT, July 2025)

My opinion: It's hard to overstate how bad this looks. If you're a founder weighing where to list London or Nasdaq the data makes the choice for you. The UK has all the ingredients (universities, talent, capital), but exits aren't credible. And without credible exits, the flywheel doesn't spin.

🛠️ How Do We Fix It?

Here's where I get opinionated: the UK and Europe can fix this, but it requires policy, structural, and cultural shifts.

1. Tax Incentives for IPOs

Exempt newly listed shares from the 0.5% stamp duty.

Offer favorable capital gains treatment for IPO investors. 👉 Listing in London should be cheaper than in New York, not more expensive.

2. Ease Regulatory Burdens

Streamline compliance and reduce costs for AIM and main market listings.

Make dual listings easier and cheaper. 👉 Right now, only giants can afford the friction. Deep tech startups shouldn't have to bleed out before they get public.

3. Mobilize Scale-Up Capital

Expand government grant funding by increasing GDP spend.

Push pension funds into late-stage venture and IPO participation. 👉 Europe doesn't lack capital. It lacks risk-tolerant domestic capital.

4. Support IPO Readiness

Programs to help founders with governance, reporting, underwriting, and valuation.

Governments could co-invest in IPO infrastructure (market making, liquidity support). 👉 Reduce fragility. Make IPOs something companies aim for, not fear.

5. Culture Shift

Stop stigmatizing failure. Encourage second and third-time founders. 👉 Silicon Valley works because failure isn't final. Europe still treats it like a scarlet letter.

🌍 Signs of Hope

The flywheel isn't totally broken.

Mistral AI ($6.4B valuation) and DeepL ($300M raise) are building a new wave of AI champions.

Isar Aerospace and IceEye are anchoring space tech.

Newcleo and Marvel Fusion are pulling nuclear/energy into the mainstream.

These companies could be the seeds of a European deep tech flywheel but only if they scale here, exit here, and reinvest here.

🚀 Final Thought

Europe doesn't lack talent. It doesn't lack innovation. It doesn't even lack capital. What it lacks is an engine that recycles success back into the system. Comparing the US to EU is like comparing Apples to Oranges. I'm not blind to that fact but we can be better and i believe we will be.

Until we fix exits especially IPOs we'll keep exporting the upside. The UK in particular has a choice: revive London as a credible IPO hub, or watch founders go abroad.

2025 could be remembered as the year Europe stopped asking "Can we compete?" and started asking "How do we spin the flywheel faster?"

This blog is part of my mini-series on the 2025 European Deep Tech Report. Next week: I'll dive into the companies, R&D hubs, and culture shaping Europe's deep tech ecosystem.